To block your Karnataka Bank ATM card, you can contact the bank’s customer service and request the blockage. Now I will provide a well-rounded introduction.

Karnataka Bank is a renowned banking institution that offers various financial services to its customers. One of the services offered by the bank is ATM cards, which provide convenient access to funds. However, there may be instances where you need to block your ATM card due to loss or theft.

In such cases, it’s crucial to take immediate action to prevent any unauthorized transactions. This article will guide you on how to block your Karnataka Bank ATM card effectively. By following the simple steps provided, you can ensure the security of your funds and protect yourself from any potential fraudulent activities.

Reasons To Safely Block Your Card

To protect yourself against unauthorized transactions and prevent fraudulent activities, it is important to block your Karnataka Bank ATM card. By doing so, you can ensure the safety of your funds and personal information. Blocking your card immediately in case of loss, theft, or suspicion of unauthorized usage is crucial.

This action will prevent any further transactions from taking place and safeguard your hard-earned money. It is essential to be proactive and take necessary steps to secure your financial assets. By blocking your card, you are effectively minimizing the risk of potential financial loss and ensuring peace of mind.

Stay vigilant and prioritize the security of your ATM card to avoid any unfortunate incidents.

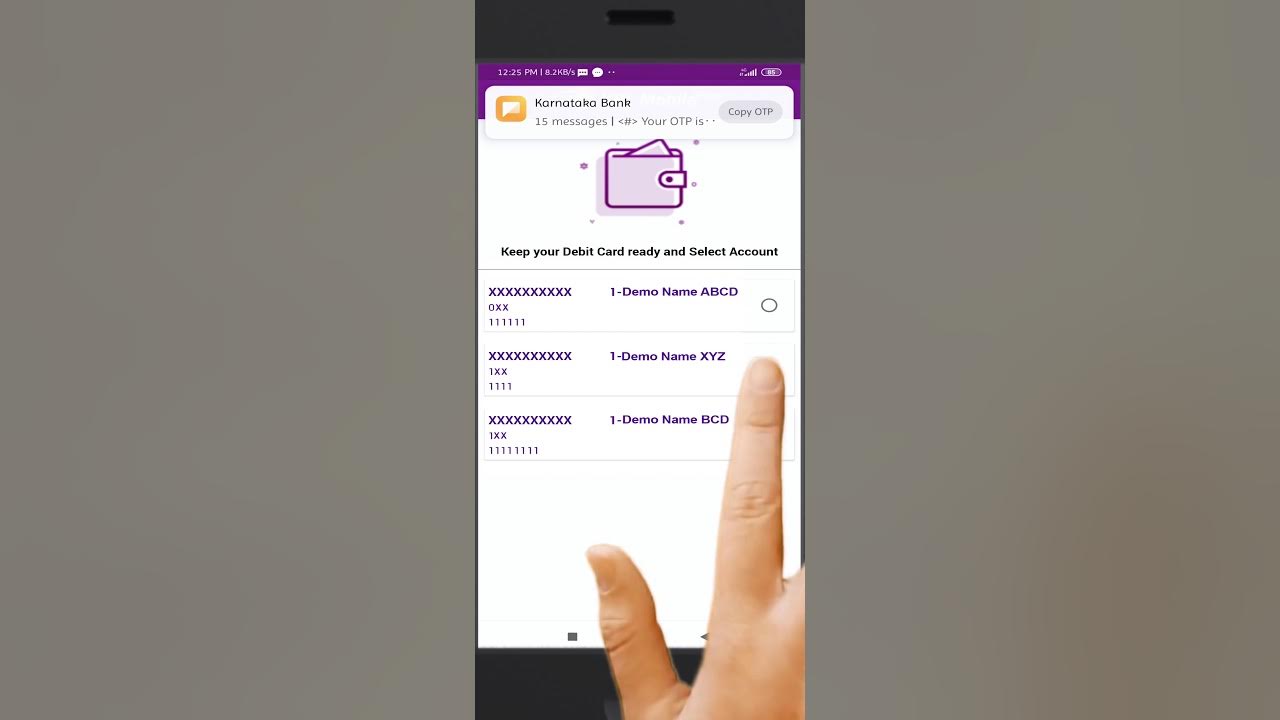

Step-By-Step Guide To Blocking Your Card

If you find yourself needing to block your Karnataka Bank ATM card, don’t panic. Take the necessary steps to protect yourself from unauthorized transactions by contacting customer support immediately. Once you’ve verified your identity and account details, request a temporary block on your card.

This will help prevent any further misuse. Additionally, make sure to report any unauthorized transactions that have already taken place. Customer support will guide you through the process and provide you with the necessary instructions. By following these steps, you can ensure the security of your funds and prevent any potential financial losses.

Additional Security Measures

To block your Karnataka Bank ATM card, it is important to take additional security measures. One of the key steps is to change your ATM PIN regularly. This helps to prevent unauthorized access to your account. Another important measure is to monitor your account on a regular basis.

Keep a close eye on your transactions and report any suspicious activity immediately. Enabling transaction alerts is also crucial for added security. This will notify you of any transactions made using your card, allowing you to promptly address any unauthorized activity.

Lastly, be cautious of phishing scams. Never share your personal or financial information with unknown individuals or through unsecured websites. Stay vigilant and protect your ATM card from potential risks.

Credit: paytm.com

Conclusion

Blocking your Karnataka Bank ATM card is a necessary security measure to protect your finances. By following the steps outlined in this blog post, you can easily block your card in case it is lost or stolen. Remember to contact the bank promptly and provide them with the necessary details such as your account number, card number, and any suspicious transactions.

It is essential to act quickly to minimize any potential damage to your funds. Furthermore, always keep your ATM card safe and avoid sharing sensitive information with strangers. By being proactive and taking the necessary steps, you can ensure the safety of your finances and have peace of mind knowing that your Karnataka Bank ATM card is protected.